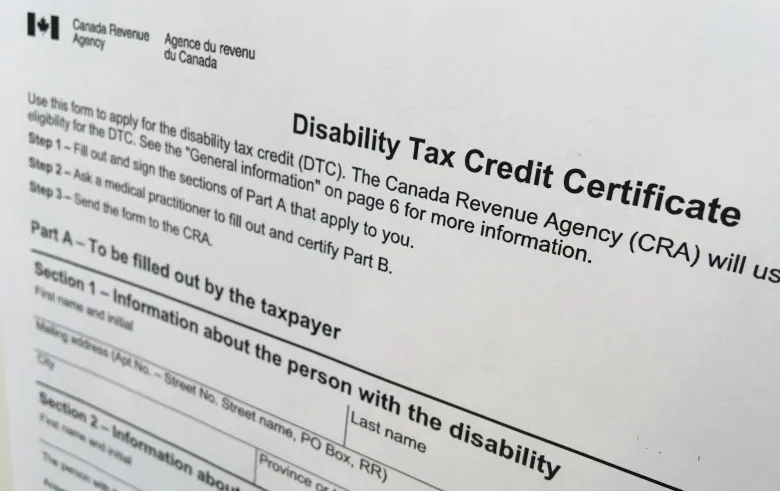

Disability Tax Credit for Canadians with Diabetes

The Disability Tax Credit (DTC) reduces the amount of income taxes eligible Canadians with Diabetes are required to pay on an annual basis. Gaining DTC approval can result in more than $45,000 in refunds paid directly from the Canada Revenue Agency, and future annual tax savings of more than $4,500 per year.

In order to receive a refund from the CRA, your household must have been paying income taxes during the years in which you suffered from your condition.

Get Started

-

Disabilities and Medical Conditions that can Qualify

At Swift, we strive to educate Canadians about the different

-

Registered Disability Savings Plan (RDSP)

The RDSP is a Canada-wide registered matched savings plan, available

-

What Is The Disability Tax Credit?

You may have questions about the Disability Tax Credit (DTC)